Gm-markets.com Review – Is Goldman Markets Scam or a Trusted Broker? (GM Markets review)

Gm-markets.com Review

In the modern trading landscape, speed, precision, and emotion-free execution can mean the difference between profit and loss. For traders looking to work smarter—not harder—Gm-markets.com presents itself as a next-gen platform centered around automation, strategy tools, and intelligent systems that do the heavy lifting.

In the modern trading landscape, speed, precision, and emotion-free execution can mean the difference between profit and loss. For traders looking to work smarter—not harder—Gm-markets.com presents itself as a next-gen platform centered around automation, strategy tools, and intelligent systems that do the heavy lifting.

Whether you’re a hands-on investor looking to test new strategies or a time-strapped professional aiming to automate your portfolio, Goldman Markets delivers the tools to bring algorithmic trading to your fingertips—without needing to write a single line of code.

Built-in Automation with Zero Coding Required

Goldman Markets takes a big leap forward byoffering rule-based automation tools that anyone can use. Through its intuitive “If-This-Then-That” engine, users can build trading bots by setting up custom conditions for market entries, exits, stop-losses, and profit targets.

Sample rule setups include:

-

If BTC drops 3% in 1 hour, sell 50% of position

-

If RSI on ETH falls below 30, place a buy order

-

If portfolio gains exceed 10% in a day, rebalance to stablecoins

These logic-based automations allow for strategic, emotion-free trading—24/7, even while you sleep.

Library of Pre-Built Strategies and Templates

Don’t want to build your own from scratch? Gm-markets.com offers a marketplace of pre-made bots and strategy templates curated by analysts and top-performing users. Strategies range from conservative dollar-cost-averaging to aggressive scalping models—all customizable to fit your risk profile.

You can backtest these strategies on historical data, simulate them in demo mode, or deploy them instantly with your live account. It’s algorithmic trading made approachable—even for complete beginners.

Live Data Feeds and Smart Triggers

The power behind Goldman Markets’s automation lies in its real-time market feed. The platform monitors dozens of data points per second across crypto, forex, and indices to trigger your rules with precision.

Supported indicators include:

-

Price action and moving averages

-

RSI, MACD, Bollinger Bands

-

Candle patterns and volume surges

-

Sentiment analysis from integrated news feeds

This allows bots to make smarter decisions—not just fast ones.

Full Asset Coverage, Not Just Crypto

Although automation shines in crypto, Gm-markets.com also supports strategy-building across:

-

Major cryptocurrencies (BTC, ETH, ADA, XRP, and more)

-

Forex markets

-

Stock CFDs and commodities

-

Market indices and ETFs

This wide coverage gives traders flexibility to build cross-market bots and adapt their portfolios to global trends.

Risk Management That Works in the Background

Every bot or rule-based strategy on Goldman Markets comes with built-in risk control settings. Users can set:

-

Max drawdown per day/week

-

Trade caps per session

-

Take-profit and stop-loss parameters

-

Circuit breakers to pause all activity during market crashes

These features are essential for keeping automated systems disciplined—and for helping traders sleep better at night.

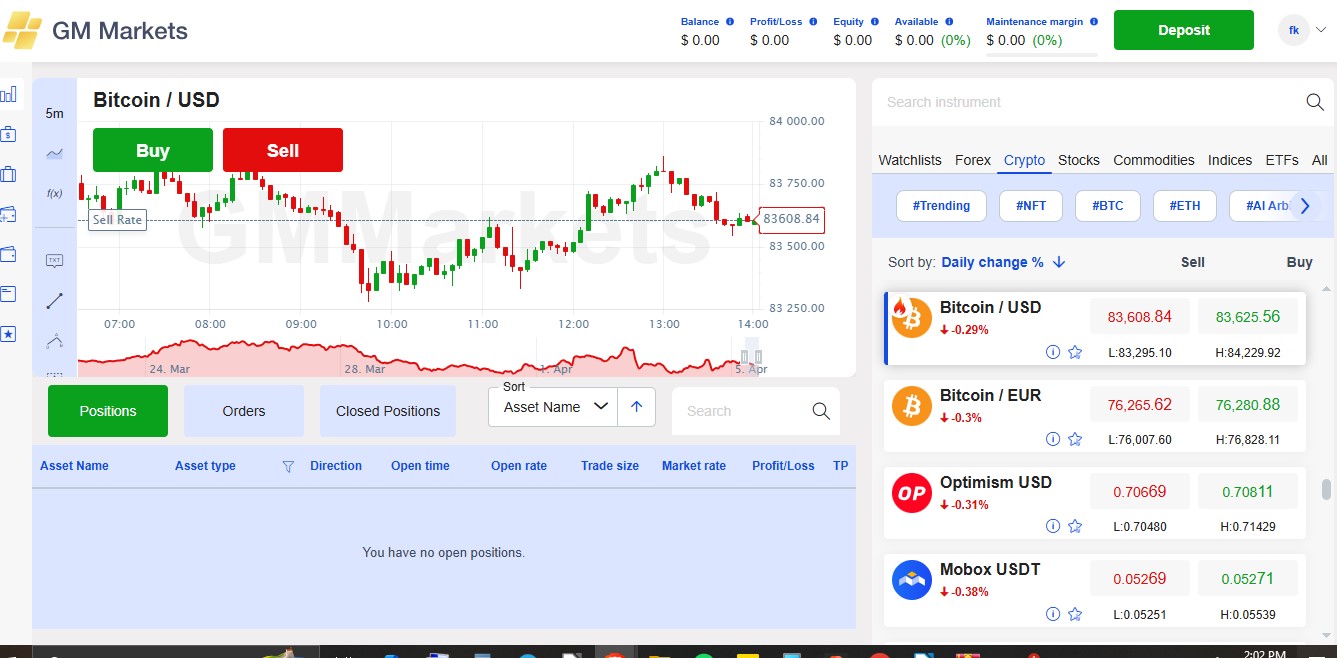

A Clean, Data-Rich Interface

Despite all this complexity under the hood, GoldmanMarkets remains easy to navigate. The dashboard includes:

-

Visual bot builder (drag-and-drop logic blocks)

-

Portfolio performance tracking

-

Strategy analytics and audit trails

-

Alerts when bots trigger trades or hit limits

Even on mobile devices, everything is responsive and easy to monitor. It’s algorithmic trading, demystified.

Secure, Regulated, and Transparent

Security is always key in automation. GM Markets secures its users with:

-

AES 256-bit encryption

-

Two-factor authentication (2FA)

-

KYC verification for bot activation

-

Segregated user funds

The platform also runs transparency reports on bot usage, showing which strategies are trending, which are outperforming, and which are risky—so you’re never left guessing.

Support for Both Builders and Beginners

Whether you’re developing a trading routine or exploring your first automation strategy, Goldman Markets provides:

-

In-app tutorials and webinars

-

AI-powered suggestions for optimizing bots

-

24/7 chat and email support

-

Access to a community forum to discuss strategy logic

Advanced users can even connect external APIs and indicators—or use developer mode for deeper customization.

Is Gm-markets.com Legit for Automated Crypto Trading?

After evaluating its automation framework, security protocols, and market tools, it’s clear that Goldman-Markets is a legitimate and forward-thinking broker. It takes the intimidation out of bot trading, replacing it with visual clarity, built-in safety, and full transparency.

This isn’t a gimmick or “black-box” automation—it’s true, customizable logic available to all.

Final Thoughts – Automate Like a Pro Without Coding

If you’re ready to remove emotion from your trades, explore algorithmic strategies, or simply save time while maintaining control—Goldman Markets offers one of the best automation platforms available for retail traders today.

With flexible rule-building, real-time logic, cross-asset functionality, and user-first design, it puts the power of professional automation tools into your hands—no coding required.